R: 4.3.2 (2023-10-31)

R studio: 2023.12.1+402 (2023.12.1+402)

Marketing Effectiveness and Resource Allocation

Leverage historical data to quantify the effectiveness of marketing actions.

1

2

3

4

5

6

7

8

9

| > spending.data <- read_xls("advertising spending 1.xls")

> str(spending.data)

tibble [200 × 5] (S3: tbl_df/tbl/data.frame)

$ week : num [1:200] 1 2 3 4 5 6 7 8 9 10 ...

$ tv : num [1:200] 230.1 44.5 17.2 151.5 180.8 ...

$ radio : num [1:200] 37.8 39.3 45.9 41.3 10.8 48.9 32.8 19.6 2.1 2.6 ...

$ newspaper: num [1:200] 69.2 45.1 69.3 58.5 58.4 75 23.5 11.6 1 21.2 ...

$ sales : num [1:200] 22.1 10.4 9.3 18.5 12.9 7.2 11.8 13.2 4.8 10.6 ...

|

数据包含每周的销售额以及电视、广播和报纸广告费用(以千英镑计)。

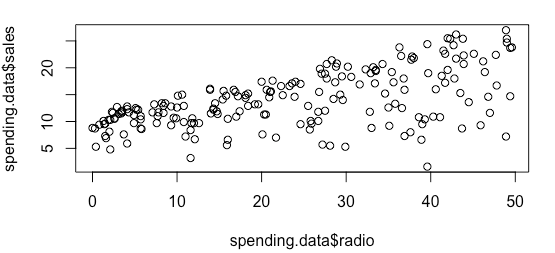

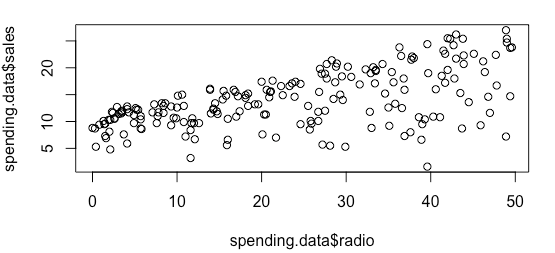

Does radio advertising affect sales for an electronics brand?

Visualizing the data

1

2

| ## scatter plot

plot(spending.data$radio, spending.data$sales)

|

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

| > # Correlation between radio advertising and sales

> cor(spending.data$radio, spending.data$sales)

[1] 0.5762226

> regression <- lm(sales ~ radio, data = spending.data)

> summary(regression)

Call:

lm(formula = sales ~ radio, data = spending.data)

Residuals:

Min 1Q Median 3Q Max

-15.7305 -2.1324 0.7707 2.7775 8.1810

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 9.31164 0.56290 16.542 <2e-16 ***

radio 0.20250 0.02041 9.921 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 4.275 on 198 degrees of freedom

Multiple R-squared: 0.332, Adjusted R-squared: 0.3287

F-statistic: 98.42 on 1 and 198 DF, p-value: < 2.2e-16

|

问题:如果我在广播广告上花费 40,000 英镑,我将卖出多少?答案:17.31 = 9.31 +0.20 * 40

Accounting for multiple predictors: multiple linear regression

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

| > regression <- lm(sales ~ radio + tv, data=spending.data)

> summary(regression)

Call:

lm(formula = sales ~ radio + tv, data = spending.data)

Residuals:

Min 1Q Median 3Q Max

-8.7977 -0.8752 0.2422 1.1708 2.8328

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 2.92110 0.29449 9.919 <2e-16 ***

radio 0.18799 0.00804 23.382 <2e-16 ***

tv 0.04575 0.00139 32.909 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 1.681 on 197 degrees of freedom

Multiple R-squared: 0.8972, Adjusted R-squared: 0.8962

F-statistic: 859.6 on 2 and 197 DF, p-value: < 2.2e-16

|

Allocating marketing budgets

Ratio of elasticities method

- What is elasticity?

- % change in the response variable for a 1% change in the predictor variable

- Example: the % change in sales for a 1% change in advertising spending

Let us start with an example:

- Image that you have a £100,000 budget to spend on advertising

- A 1% increase in online advertising increases sales by 0.12%

- A 1% increase in offline advertising increases sales by 0.08%

如何使用弹性系数法?

- 总弹性系数:0.12 + 0.08 = 0.20。

- 弹性系数比率:

- 在线广告:0.12/0.20 = 60%

- 线下广告:0.08/0.20 = 40%

建议:将60%(£60,000)的预算分配给在线广告,40%(£40,000)的预算分配给线下广告。

How to obtain elasticities from a linear regression model?

- 广告弹性 = 广告估算值 * (基线广告/基线销售)

- 基线广告 = 平均广播广告支出(=23.26)

- Baseline Sales = average sales (=14.02)

- What is the elasticity of radio advertising? (0.32)

- A 1% increase in radio advertising results in a 0.32% increase in sales.

1

2

3

4

5

6

7

8

| > mean(spending.data$radio)

[1] 23.264

> mean(spending.data$sales)

[1] 14.0225

> 0.19 * (23.26/14.02)

[1] 0.3152211

|

Marketing Mix Modelling

Modelling non-linear returns on investment

假设广告在初始预算为50万英镑的情况下在1周内播出,旨在提高英国消费者对Airbnb作为一个包容性品牌的认知,同时增加访问Airbnb网站和预订的流量。

由于该广告活动的结果,Airbnb的预订量增加了1%。

一年后,Airbnb决定再次进行一场相似的广告活动,同样持续1周,但将预算翻倍至100万英镑,希望预订量会增加2%。

你认为会发生这种情况吗?为什么(为什么不)?

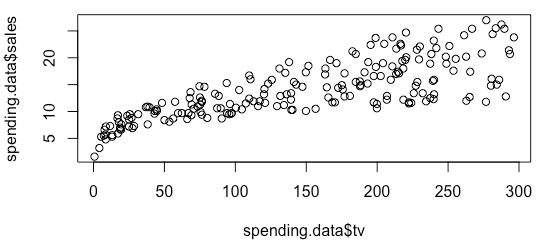

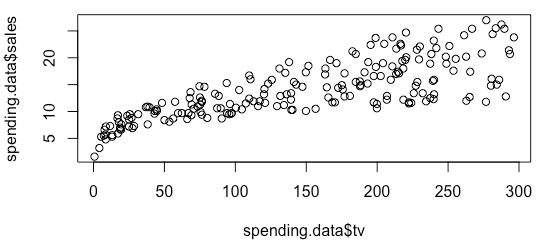

“电视和广告之间的关系是否线性?”

1

| plot(spending.data$tv, spending.data$sales)

|

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

| > summary(spending.data$sales)

Min. 1st Qu. Median Mean 3rd Qu. Max.

1.60 10.38 12.90 14.02 17.40 27.00

> summary(spending.data$tv)

Min. 1st Qu. Median Mean 3rd Qu. Max.

0.70 74.38 149.75 147.04 218.82 296.40

> summary(spending.data$radio)

Min. 1st Qu. Median Mean 3rd Qu. Max.

0.000 9.975 22.900 23.264 36.525 49.600

> summary(spending.data$newspaper)

Min. 1st Qu. Median Mean 3rd Qu. Max.

0.30 12.75 25.75 30.55 45.10 114.00

> regression <- lm(log(sales) ~ log(radio+0.01) + log(tv) + log(newspaper), data=spending.data)

> summary(regression)

Call:

lm(formula = log(sales) ~ log(radio + 0.01) + log(tv) + log(newspaper),

data = spending.data)

Residuals:

Min 1Q Median 3Q Max

-0.45346 -0.08881 -0.01746 0.06781 0.78863

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.479773 0.052031 9.221 <2e-16 ***

log(radio + 0.01) 0.144177 0.007865 18.333 <2e-16 ***

log(tv) 0.349297 0.008857 39.437 <2e-16 ***

log(newspaper) 0.017488 0.009306 1.879 0.0617 .

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.1254 on 196 degrees of freedom

Multiple R-squared: 0.9098, Adjusted R-squared: 0.9084

F-statistic: 658.7 on 3 and 196 DF, p-value: < 2.2e-16

|

我们已经将0.01添加到广播的值上,因为广播的最小值是0,这样做会导致对log(广播)的无效结果。

1

2

3

4

5

6

7

8

9

| Linear

• Equation: Y = β0 + β1X

• Interpretation: One unit change in X leads to beta1 unit change in Y

• When to use? Linear relation between X and Y

Log-Log

• Equation: log(Y) = β0 + β1log(X)

• Interpretation: One percent change in X leads to β1 percent change in Y • When to use? A non-linear relation between X and Y

Which one to use?

• Plot the data to learn about the relation between X and Y. • Estimate both models and identify the best fitting model

|

- 营销组合工具的综合使用可以产生协同效应。

- 当多种媒体的联合影响超过它们各自部分的总和时,就会产生协同效应。

Is TV advertising more effective in the presence of radio advertising?

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

| > regression <- lm(log(sales) ~ log(radio+0.01) + log(tv) + log(newspaper) + log(radio+0.01)*log(tv), data=spending.data)

> summary(regression)

Call:

lm(formula = log(sales) ~ log(radio + 0.01) + log(tv) + log(newspaper) +

log(radio + 0.01) * log(tv), data = spending.data)

Residuals:

Min 1Q Median 3Q Max

-0.29117 -0.06889 -0.02084 0.05787 0.74453

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.347498 0.101811 13.235 < 2e-16 ***

log(radio + 0.01) -0.152661 0.032200 -4.741 4.10e-06 ***

log(tv) 0.153799 0.022032 6.981 4.49e-11 ***

log(newspaper) 0.019947 0.007741 2.577 0.0107 *

log(radio + 0.01):log(tv) 0.066311 0.007043 9.415 < 2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.1043 on 195 degrees of freedom

Multiple R-squared: 0.938, Adjusted R-squared: 0.9367

F-statistic: 737 on 4 and 195 DF, p-value: < 2.2e-16

|

使用中心化变量

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

| > center <- function(x) { scale(x, scale = F)} # scale = F, means only center not standardize

> spending.data <- spending.data %>% mutate(radio_log_centered = center(log(radio+0.01)),

+ tv_log_centered .... [TRUNCATED]

> regression <- lm(log(sales) ~ radio_log_centered + tv_log_centered + newspaper_log_centered +

+ radio_log_centered*tv_log_centere .... [TRUNCATED]

> summary(regression)

Call:

lm(formula = log(sales) ~ radio_log_centered + tv_log_centered +

newspaper_log_centered + radio_log_centered * tv_log_centered,

data = spending.data)

Residuals:

Min 1Q Median 3Q Max

-0.29117 -0.06889 -0.02084 0.05787 0.74453

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 2.561748 0.007376 347.306 <2e-16 ***

radio_log_centered 0.157146 0.006681 23.521 <2e-16 ***

tv_log_centered 0.337076 0.007476 45.086 <2e-16 ***

newspaper_log_centered 0.019947 0.007741 2.577 0.0107 *

radio_log_centered:tv_log_centered 0.066311 0.007043 9.415 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.1043 on 195 degrees of freedom

Multiple R-squared: 0.938, Adjusted R-squared: 0.9367

F-statistic: 737 on 4 and 195 DF, p-value: < 2.2e-16

|

Modelling carryover effects

到目前为止,我们假设在给定时间段内的广告只会影响该时间段内的销售。实际上,消费者对广告的反应可能会有延迟。不考虑延迟效应可能会导致广告弹性系数被低估。

广告存量度量了广告在当前时间段之外的影响。

广告存量背后的理论是,营销曝光在消费者心中建立了意识。这种意识不会在消费者看到广告后立即消失,而是留存在他们的记忆中。记忆会随着时间的推移而减弱,因此广告存量中存在衰减部分。

1

| Adstockt = Advertisingt + λAdstockt−1

|

在每个时间段中,你被认为会保留前一个广告存量的一部分(λ)。

例如,如果λ等于0.3,则来自一个时间段之前的广告存量在当前时间段仍然具有30%的影响。

How to do this in R?

- “rate = 0.1” sets λ to 0.1 (i.e. 10%)

- You can empirically test multiple values of λ.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

| > adstock <- function(x, rate){

+ return(as.numeric(stats::filter(x=x, filter=rate, method="recursive")))

+ }

> # filter() function from stats package applies linear filtering to a univariate time series

>

> spending.data <- spending.data %>% mutate(tv_adstoc .... [TRUNCATED]

> regression <- lm(log(sales) ~ log(radio+0.01) + log(tv_adstock) + log(newspaper), data=spending.data)

> summary(regression)

Call:

lm(formula = log(sales) ~ log(radio + 0.01) + log(tv_adstock) +

log(newspaper), data = spending.data)

Residuals:

Min 1Q Median 3Q Max

-0.96605 -0.08394 -0.00081 0.07966 0.81860

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.09547 0.08418 -1.134 0.2581

log(radio + 0.01) 0.13177 0.01008 13.074 <2e-16 ***

log(tv_adstock) 0.45582 0.01542 29.567 <2e-16 ***

log(newspaper) 0.02219 0.01190 1.865 0.0637 .

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.1604 on 196 degrees of freedom

Multiple R-squared: 0.8523, Adjusted R-squared: 0.8501

F-statistic: 377.1 on 3 and 196 DF, p-value: < 2.2e-16

|

Predictive accuracy *

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

| > # Total number of rows in the data frame

> n <- nrow(spending.data)

> # Number of rows for the training set (80% of the dataset)

> n_train <- round(0.80 * n) # Training data

> spending.data.train <- subset(spending.data, week <= n_train) # Holdout data

> spending.data.holdout <- subset(spending.data, week > n_train)

> # Estimation on training data

> regression <- lm(log(sales) ~ log(radio_adstock) + log(tv_adstock) + log(newspaper_adstock), data=spending.data.trai .... [TRUNCATED]

> summary(regression)

Call:

lm(formula = log(sales) ~ log(radio_adstock) + log(tv_adstock) +

log(newspaper_adstock), data = spending.data.train)

Residuals:

Min 1Q Median 3Q Max

-0.95544 -0.06206 -0.00140 0.07359 0.60782

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.37264 0.09377 -3.974 0.000108 ***

log(radio_adstock) 0.19215 0.01473 13.048 < 2e-16 ***

log(tv_adstock) 0.47022 0.01566 30.031 < 2e-16 ***

log(newspaper_adstock) 0.02057 0.01545 1.332 0.184852

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.1483 on 156 degrees of freedom

Multiple R-squared: 0.8812, Adjusted R-squared: 0.8789

F-statistic: 385.6 on 3 and 156 DF, p-value: < 2.2e-16

|

1

2

3

4

5

6

7

8

9

10

11

12

| > # Predict sales on holdout data

> spending.data.holdout$predicted_sales_log <-

+ predict(object =regression, newdata = spending.data.holdout)

> # Convert predicted log sales to actual sales

> spending.data.holdout$predicted_sales <- exp(spending.data.holdout$predicted_sales_log)

> # Quantify predictive accuracy: Mean Average Percentage Error (MAPE)

> mape <- mean(abs((spending.data.holdout$sales -spending.data.holdout$predicte .... [TRUNCATED]

> mape # Reflects the average percentage error in a given week

[1] 0.1010304

|

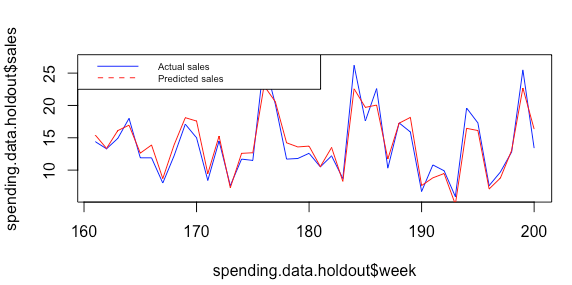

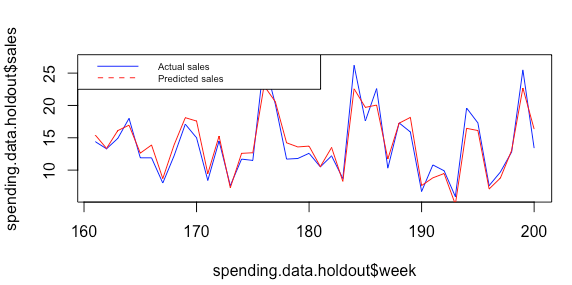

1

2

3

4

5

6

| > # Plot actual versus predicted sales

> plot(spending.data.holdout$week, spending.data.holdout$sales, type="l", col="blue") # Plot actual sales

> lines(spending.data.holdout$week,spending.data.holdout$predicted_sales, type = "l", col = "red") # Add predicted sales

> legend("topleft", legend=c("Actual sales", "Predicted sales"), col=c("blue", "red"), lty = 1:2, cex=0.6)

|